If you own or manage an SMB in Washington, D.C., understanding the local industry landscape isn’t just a nice-to-have, it’s a strategic necessity. In the first quarter of 2025, the District of Columbia’s real gross state product (GSP) was estimated at $149.4 billion, reflecting the strength of dominant sectors like government, professional services, and tourism.

These industries set the pace for business activity across the region and create steady demand for innovative, adaptable services.

George Hammerschmidt, Executive VP and COO at Nortec, notes: “The businesses that thrive in D.C. are the ones that pay attention to local needs, understand how the city works, and build connections. When you notice gaps and opportunities early, you can offer solutions that really make a difference.”

Let’s explore what this means for your business today.

Top Industries in Washington Driving Growth and Opportunity

Washington, D.C. isn’t just the nation’s capital, it’s also a hub for a wide range of industries that create jobs, drive innovation, and offer opportunities for small and medium-sized businesses. Let’s break down the main sectors in a clear, simple way:

1. Government and Public Administration

This is the biggest industry in D.C. by far. In fact, the government industry contributed the most to the District of Columbia’s GDP in 2024, generating a value of $44.7 billion. Think of all the federal agencies, departments, and offices, they need people to run them, manage programs, and provide services. But it’s not just government employees: many local businesses work as contractors, consultants, or service providers for these agencies. If you run a small business, there are opportunities to support government projects in areas like IT, administration, or security. Simply put, the government drives almost everything in D.C.’s economy.

2. Professional Services and Consulting

Because D.C. is the heart of politics and policymaking, there’s huge demand for experts who understand laws, regulations, and policy. This includes law firms, management consultants, lobbyists, and strategy advisors. Businesses in this sector help clients navigate complicated rules, provide advice, or advocate for certain policies. For small companies, there’s room to specialize in a niche area, like legal services for nonprofits or consulting for government programs.

3. Technology and Cybersecurity

D.C.’s tech scene is growing fast, especially in areas tied to government work. Cybersecurity, cloud services, and IT support are in high demand because federal agencies need secure, reliable systems.

In fact, Washington D.C.’s cybersecurity job market shows 15% growth through 2025, with over 1,000 immediate openings in the DMV area and entry-level salaries starting at $106,216. While it’s not a “tech city” like Seattle or San Francisco, D.C. is strong in tech solutions for government, defense, and security. Small tech firms often find opportunities by providing specialized software, secure networks, or consulting services for public institutions.

4. Education and Research

The city is home to top universities, think tanks, and research centers. These organizations study everything from economics and politics to public health and international relations. They hire researchers, educators, and support staff, and they often need vendors for technology, events, and consulting. If you run a small business, you could provide services to support education programs, research projects, or conferences. This sector is especially strong because D.C. combines learning, policy, and innovation all in one place.

5. Healthcare and Life Sciences

D.C. has hospitals, clinics, and public health organizations that serve both residents and government programs. While it’s not the biotech capital of the U.S., there is growing work in medical research, health IT, and services that support hospitals and health programs.

In D.C., proximity to government agencies and major research institutions accelerates tech and health innovation, as seen with firms like CaryHealth, which ranked #82 on the Inc. 5000 in 2024 for its AI-driven healthcare solutions.

Companies that provide technology solutions, medical equipment, digital health tools, or consulting services can find strong opportunities in this environment. Public health initiatives, especially those led by the federal government, also create consistent demand for specialized services.

Smart IT for Smart Businesses

From managed IT to disaster recovery, get solutions that adapt as your business grows. Make technology a strength, not a stress.

6. Tourism, Hospitality, and Cultural Services

Washington, D.C. tourism remains robust despite 2025 headwinds, building on the 2024 record of 27.2 million visitors, who generated $11.4 billion in spending and supported 111,500 jobs. This strong visitor flow fuels a wide range of business activity across the city.

Millions of people visit D.C. each year to explore its monuments, museums, and historic sites. As a result, hotels, restaurants, event planners, and creative businesses all benefit from steady demand. Tourism also drives significant opportunities for small businesses—from souvenir shops and guided tours to catering for conferences and cultural events. This sector remains consistently strong because people continue to seek out D.C.’s history, culture, and special events year after year.

7. Media and Communications

D.C. is a hub for national media, PR firms, and digital communications companies. With so much political activity, there’s constant need for news coverage, public relations, and social media content. Businesses in this sector help politicians, nonprofits, and organizations communicate their message clearly. Small firms can thrive by offering specialized media services, content creation, or communications consulting.

Key Forces Shaping Industries in Washington’s Business Landscape for SMB Owners

As an SMB owner in Washington, you’re navigating a business landscape defined by rapid change and unique regional dynamics. Several key forces are at play:

- Tech Workforce Density: The concentration of skilled tech professionals means recruiting is fiercely competitive, and expectations for digital transformation are high-impacting both hiring and operational strategy.

- Global Market Pressures: Export-driven sectors face volatility as international demand and regulations evolve, especially in aerospace and agriculture.

- Infrastructure Modernization: With 80% of organizations agreeing that inadequate or outdated technology is holding back innovation, keeping up with technology upgrades is no longer optional

- Environmental Sustainability: New climate policies and green initiatives are prompting changes in core operations, particularly for maritime and agricultural businesses.

- Talent Pipeline: As 92% of jobs now require digital skills, workforce development and upskilling are quickly becoming non-negotiable priorities.

More articles you might like:

Gaining Traction in Washington Industries: A Guide for SMB Owners

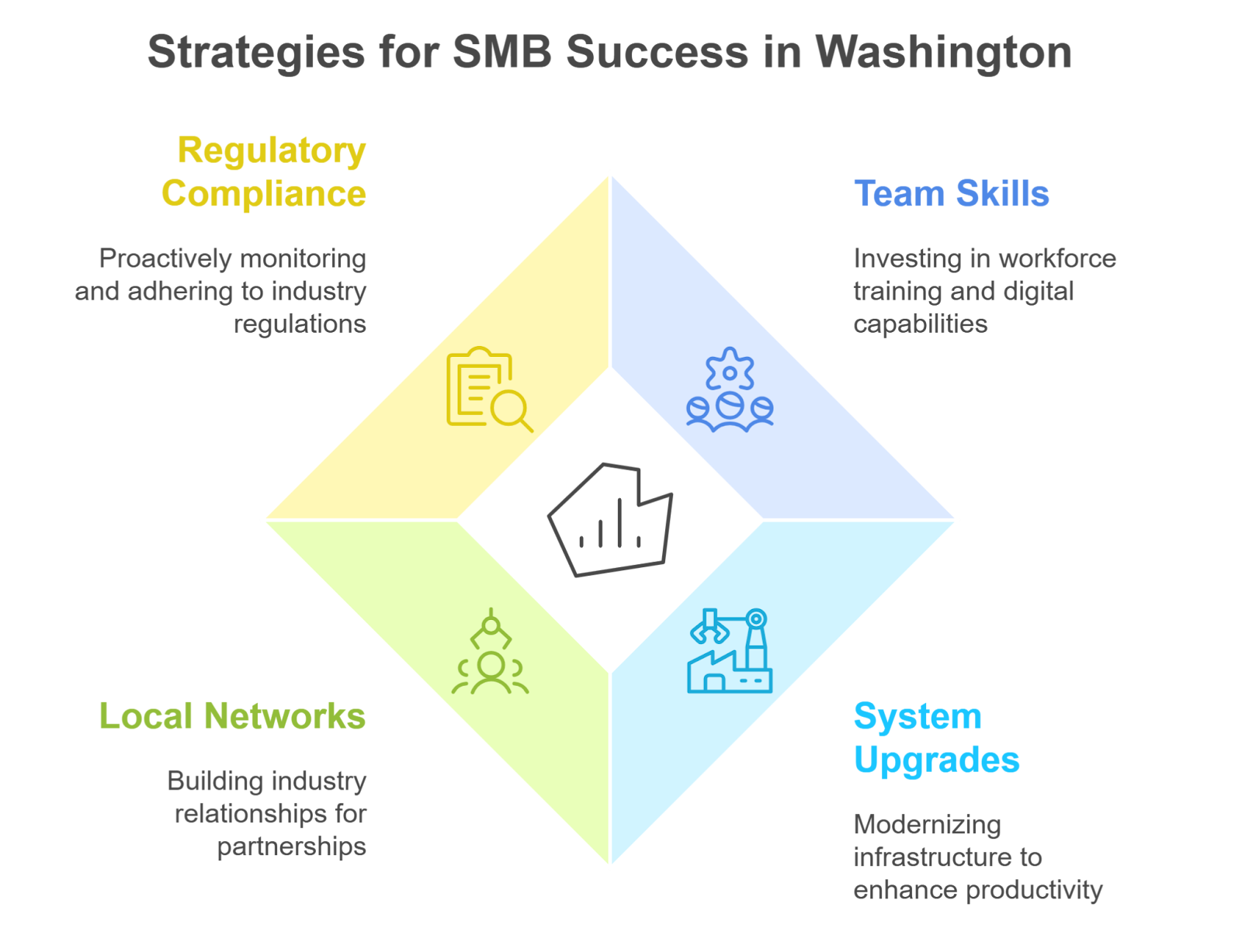

Thriving in Washington, D.C.’s key sectors, such as government contracting, technology, professional services, healthcare, and nonprofit/advocacy work, requires adaptability and strategic thinking. Success comes from pairing thoughtful planning with the right tools, connections, and local insight.

- Invest in Team Skills: Equip your workforce with the knowledge and digital capabilities needed to meet evolving industry demands. Training and continuous learning make your business more agile and competitive.

- Upgrade Your Systems: Modern infrastructure keeps operations running smoothly and prevents slowdowns that can hold back growth. Even small improvements can have a big impact on productivity.

- Tap into Local Networks: Building relationships with industry peers opens doors to partnerships, shared resources, and new opportunities that are often hidden from view.

- Stay Ahead of Regulations: Industries like maritime and agriculture are highly regulated. Proactively monitoring changes ensures compliance and helps you avoid costly setbacks.

By focusing on these priorities, SMBs can operate more efficiently, respond faster to challenges, and position themselves for long-term growth in Washington’s most influential industries.

Common Challenges SMBs Face in the Biggest Industries in Washington

| Challenge | Strategic Response |

| Rapidly evolving technology | Invest in continuous staff training and adopt scalable digital solutions |

| High compliance and regulatory requirements | Focus on quality, certification, and proactive monitoring of regulations |

| Market volatility and seasonal fluctuations | Diversify offerings, plan for contingencies, and adopt flexible operations |

| Talent acquisition and retention | Upskill staff, offer competitive benefits, and build partnerships with local training programs |

| Limited access to capital or resources | Explore grants, government programs, and local industry networks |

| Cybersecurity threats | Ransomware and extortion attacks are a top threat in 92% of industries. Protect your business with managed cybersecurity, regular backups, staff training, and a solid incident response plan |

Discover How Washington’s Industry Experts Tailor IT Solutions for Your Business

Finding IT partners who understand the unique pressures of your sector is key to business success. Rather than offering generic solutions, Nortec takes a flexible approach, scoping each project individually to meet your specific needs and avoid the pitfalls of cookie-cutter packages.

This approach ensures that your business receives reliable and responsive support. With 98% of issues addressed in under 2 hours, Nortec allows your team to focus on growth and core operations instead of daily IT challenges. Serving businesses of all sizes, from small teams to hundreds of users, Nortec tailors managed IT, cloud, and cybersecurity services to the realities of Washington’s SMB landscape.

Reach out to Nortec for guidance grounded in local expertise and experience. Modernize securely and efficiently, streamline operations, and leverage IT solutions designed specifically to help Washington SMBs thrive in a competitive and evolving market.